| Kurse | Charts | Stammdaten | Kennzahlen | Aktion |

|---|---|---|---|---|

| Snapshot | Preischart | Daten + Gebühr | Performance | Portfolio |

| Börsenplätze | Performance | Management | Volatilität | Watchlist |

| Historisch | Benchmark | Sharpe Ratio | ||

| Rendite | Ratings |

Kurse

Charts

Stammdaten

Kennzahlen

Nettoinventarwert (NAV)

| 90.99 EUR | -0.10 EUR | -0.11 % |

|---|

| Vortag | 91.09 EUR | Datum | 22.01.2025 |

Anzeige

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 491.70% | |

| 21Shares Stellar ETP | CH1109575535 | 352.33% | |

| 21Shares Algorand ETP | CH1146882316 | 241.42% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 227.84% | |

| 21Shares Cardano ETP | CH1102728750 | 179.10% | |

| 21Shares Sui Staking ETP | CH1360612159 | 129.64% | |

| 21Shares Injective Staking ETP | CH1360612134 | -1.13% | |

| 21Shares Immutable ETP | CH1360612142 | -20.47% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Sui Staking ETP | CH1360612159 | 425.62% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 413.73% | |

| 21Shares Stellar ETP | CH1109575535 | 311.72% | |

| 21Shares Aave ETP | CH1135202120 | 246.50% | |

| 21Shares Algorand ETP | CH1146882316 | 176.60% | |

| 21Shares Stacks Staking ETP | CH1258969042 | 145.10% | |

| 21Shares Injective Staking ETP | CH1360612134 | -20.51% | |

| 21Shares Immutable ETP | CH1360612142 | -23.45% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Ripple XRP ETP | CH0454664043 | 499.37% | |

| 21Shares Stellar ETP | CH1109575535 | 282.07% | |

| 21Shares Aave ETP | CH1135202120 | 278.62% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 250.09% | |

| 21Shares Solana staking ETP | CH1114873776 | 208.68% |

| Name | ISIN | Performance | |

|---|---|---|---|

| 21Shares Solana staking ETP | CH1114873776 | 970.95% | |

| 21Shares Ripple XRP ETP | CH0454664043 | 608.15% | |

| 21Shares Crypto Basket Equal Weight (HODLV) ETP | CH1135202161 | 364.59% | |

| 21Shares Bitcoin Core ETP | CH1199067674 | 358.47% | |

| 21Shares Bitcoin ETP | CH0454664001 | 346.87% |

Fundamentaldaten

| Valor | 21758934 |

| ISIN | LU0935227701 |

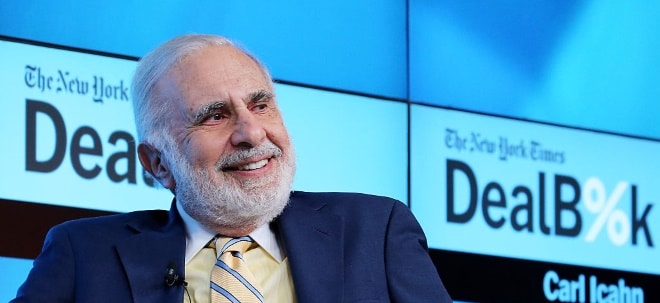

| Emittent | Natixis Investment Managers International |

| Aufgelegt in | Luxembourg |

| Auflagedatum | 25.06.2013 |

| Kategorie | Mischfonds EUR defensiv - Global |

| Währung | EUR |

| Volumen | 51’670’687.03 |

| Depotbank | Brown Brothers Harriman (Lux) SCA |

| Geschäftsjahresende | 30.06. |

| Berichtsstand | 22.01.2025 |

Anlagepolitik

So investiert der Natixis AM Funds - Natixis Conservative Risk Parity R/D (EUR) Fonds: Based on a balance of risks among a wide range of asset classes, the Sub-Fund seeks a long-term capital growth and positive returns throughout economic and markets cycles over its recommended minimum investment period of 3 years. The Sub-Fund objective is to outperform by 4% (gross of fees) the daily capitalized €STR. The Sub-Fund is actively managed. For indicative purposes only, the Sub-Fund's performance may be compared to the Reference Index. However, it does not aim to replicate that Reference Index and may therefore significantly deviate from it.

ETP Performance: Natixis AM Funds - Natixis Conservative Risk Parity R/D (EUR) Fonds

| Performance 1 Jahr | 5.37 | |

| Performance 2 Jahre | 4.60 | |

| Performance 3 Jahre | -2.89 | |

| Performance 5 Jahre | -3.27 | |

| Performance 10 Jahre | 3.87 |